2 min.

read

2 min.

read

Since the beginning of 2020, Covid-19’s pandemic had a large impact on the global economy. The banking sector was primarily affected and it had to alleviate the financial pressure of its clients as well as accelerate its digitization processes. Several countries had to close their bank branches or keep them open offering reduced hours including offering in-person banking services to those who had previously scheduled meetings.

This caused a lot of pressure and the need to take urgent measures such as implementing telephone reservation or online systems as well as motivating users to use their digital channels through advertising and/or educational campaigns for said purposes.

The reality is that all banks accounted for a large increase in digital transactions, although the Caribbean was the region that registered the lowest growth while the Southern Cone was the one who registered the largest growth. The Andean region as well as the Central American region manifested a growth level between 25% to 75%.

This information is derived from the first Digital Banking study in Latam & Caribbean regions performed by Infocorp during June 2020 seeking to identify the level of satisfaction from banks with their digital channels, the amount and variety of services banks are capable to offer via this channel, and the strategies banks will implement in the next 12 months.

The study included the participation of 130 persons and 83 different banks segmented in four countries to conduct the analysis: Southern Cone (Integrated by Argentina, Paraguay, and Uruguay), Caribbean (Mexico, Puerto Rico, and Dominican Republic), Andean Region (Bolivia, Chile, Colombia, Ecuador, Peru and Venezuela), and Central America (Costa Rica, Guatemala, Nicaragua, Honduras and Panama).

The situation lays bare some of the difficulties banks are manifesting which at the moment introduce a relatively low satisfaction level with the channels.

The perception of the involved parties themselves is that the region is falling behind in relation to the services they offer via these channels. Only 17% of banks surveyed are extremely satisfied with web channel performance. As regards mobile channel performance, the percentage is even lower, being only nine percent of banks (9%) that are completely satisfied with the solution they currently offer.

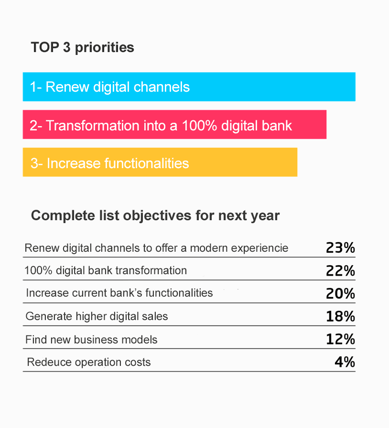

Impact in bank’s objectives

Almost one-fourth of banks seek to renew their digital channels in the next 12 months, while 22% seek a 100% digital bank transformation.

The acceleration in digitization is a situation that is obviously not exclusive of this area of the world. According to Business Insider, to the extent coronavirus crisis progresses, the adoption of digital channel has become almost omnipresent among US adults. 91% of the surveyed respondents declared that they performed some type of online banking activities in the last 30 days according to the Deposit Accounts survey performed between the 24th and 26th of July of 2020.

Said study indicated that 46% of surveyed respondents declared the most popular digital banking behavior was to verify the account balance, followed by check deposits (40% of surveyed respondents), making a payment or transferring funds to another account (34%).

The publication also indicates mobile banking’s use is gradually increasing, and four out of ten consumers declared they are using the mobile application of their bank more often than before the pandemic, and 37% of the surveyed respondents declared they were using the mobile application of their bank more than twice a week.

The challenges as well as opportunities are high. Infocorp. provides Out of the Box solutions as well as the integration of a chatbox to speed up the delivery of information to users with a Time to Market period as of three weeks, as well as a new application with predictive functionalities to offer bank clients omnichannel and intelligent real experiences according to the most demanding parameters.

Our team is prepared to help clients love their banks. Shall we talk about it?