Latin American and Caribbean banks concerned about their internal culture as a challenge to innovation

2 min.

read

2 min.

read

People increasingly demand the possibility of carrying out more transactions through their Banks’ digital channels, however, it is not always easy for these to meet expectations. According to a study mentioned by Business Insider, almost half (48%) of respondents say they are satisfied with all the features offered by their bank's app, but many other respondents pointed to a list of new features that would improve their customer experience. These include the possibility of paying for goods and services (desired by 19% of respondents), an option to more easily chat with a representative in real time (14%), and access to offers or discounts based on their spending (11%).

For his part, Paul H. Müller, co-founder and CTO of Adjust maintains that “The impact that the pandemic has had on banking applications and the growth of mobile digital services should not be underestimated. Although the banking sector has been adapting to digital disruption for several years, COVID-19 is accelerating the transformation, opening access and opportunity for millions of consumers with little or no access to banking services around the world. "

According to a report made by his company, the number of sessions in payment applications had an average increase of 49% in the countries that participated in it: The most impressive growth rates were in: Japan (75%), Germany (45%), Turkey (39%), the United States (33%) and Great Britain (29%). Users increasingly use mobile applications to carry out their transactions and comply with the rules of social distancing.

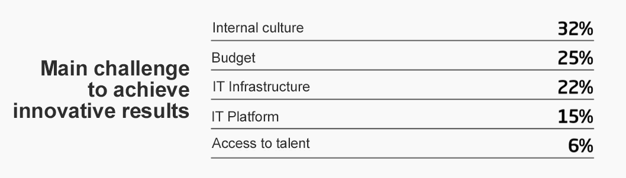

In Latam & Caribe, according to our 1st Latam & Caribe Study on Digital Banking, although digital transactions grew during the current pandemic, banks feel they have a lot to do and 32% say that the internal culture is a challenge for innovation, over budget, which was mentioned as the main challenge, in a recent study by Infocorp.

It is therefore convenient to accompany the initiatives with workshops on digital Mindset for managers and middle managers, in order to align the different members of the organization towards common objectives.

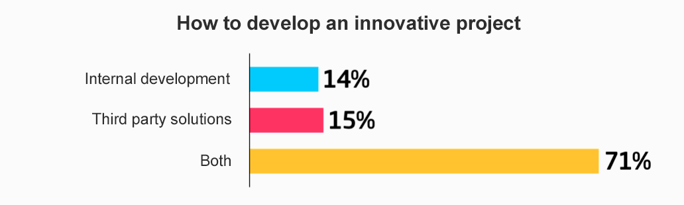

Likewise, it was revealed that only 18% of banks have an internal development area that allows them to create innovative solutions, so it is essential that they can work and rely on companies that are true partners to create together a strategic vision and a roadmap of implementations according to their needs.

Obviously the first months of 2020 were challenging for everyone and banks had to abandon some projects, or leave them on standby, to focus on urgent issues. Therefore, after 2019, which was a record year for the launch of new financial applications in the world, Apptopia data revealed that the number of banking and payment applications launched during the first half of 2020 was lower than in previous years . Together, new finance apps added to the Google Play Store and App Store worldwide were down 18%.

However, it is time to get back on track. At Infocorp we are prepared to launch a completely renewed mobile App that will make it possible to generate truly innovative experiences and that is why we call it the App of the Future. And as we understand the moment, our new agile B-Fly methodology ensures a Time to Market such as you've never seen before. We are ready to accompany you on your trip.