4 min.

read

4 min.

read

Undoubtedly, COVID-19 has accelerated changes in all markets, and the banking industry is no exception. A first impact has been the exponential growth of bank deposits due to the incentive checks or grants that users receive from governments who have encouraged the expansion of #digitalbanking, especially the use of banking apps for their usufruct.

However, this peak in liquidity has not been the same for all banks, bigger banks have benefited from the search of digital customers. In this context, what can small banks do to succeed?

In fact, the distribution of the growth of deposits has been unequal for banks of different sizes. For instance, in the United States, the growth of bank deposits during 2020 was higher than 10%. The biggest banks attracted most of it, while smaller ones stayed behind.

The following is a simple explanation: big banks can escalate the investment in technology improving their efficiency at a lower cost. Unlike for most smaller banks, for whom the investment in technology keeps being a limiting factor.

Digital banking: situation of small and medium banks

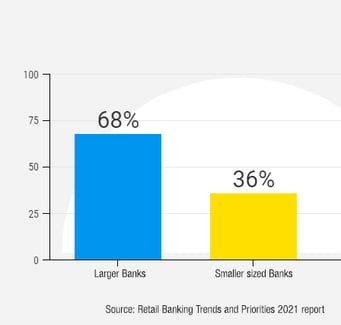

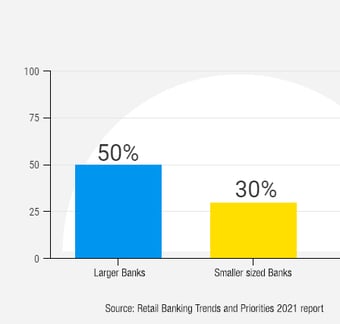

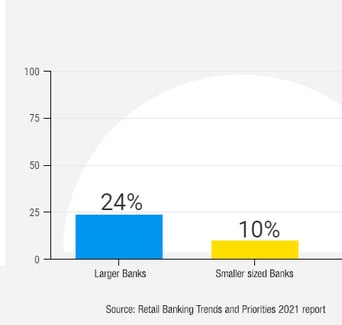

According to the Retail Banking Trends and Priorities 2021 report, 57% of the smaller banks leaders consider that they are in the first stages of digital transformation. On the other hand, 48% of bigger institutions thought they were beyond halfway point. These differences can be clearly observed when we consider the progress of the different strategies in digital banking:

End-to-end digital account opening:

Digital addition of new customers:

Customer care Chatbot:

The digital gap between the small or medium banks and the bigger ones compromises their market competitiveness, that’s why it’s necessary to carry out actions to enhance and expand digital banking services.

Success factors of digital banking

The three key challenges for smaller financial institutions are:

- Eliminate friction in the customer experience

- Incorporate analytics into their management processes

- Train and attract digital talent.

How can these goals be met?

Improving the customer experience

During the last years, we have witnessed the increase of consumer preference for Digital banking. Consumers want to make deposits online or send money to their families, manage their finances, or simply open an account. The pandemic has only accelerated this trend.

On the one hand, the database of young consumers has increased, as well as that of people over 50 years old. In fact, the biggest growth has taken place in the elderly segment, who have been the traditional base of small banks.

Even if the number one priority of the financial sector is to add new features and enhance the customer experience, the great majority of bankers admit that they are not prepared: only 17% believe they can offer a great digital experience to their customers.

What can small and medium banks do? The base to improve the experience is to know what your customers’ expectations are. In that sense, these are some of the trends for 2021:

- Speed and simplicity rule. Customers’ expectations go from prices and quality to speed and simplicity.

- Channel alignment is assumed. Consumers want the experience between digital and in-person channels to be seamless.

- Service customization. Join the information coming from the interaction with the internal and external knowledge for the application in the customer experience and offer it in such a way that is relevant to the context.

A positive perception of your customer translates into trust and more transactions for your bank.

Increasing data maturity and analytics

While smaller banks haven’t paid much attention to data analytics in the past, this has now changed. According to #JimMarous, 56 % of small banks consider analytics as one of their three priorities.

Big data and artificial intelligence are considered more than technologies, they represent business assets. You can predict what a customer needs, even before he knows, you can learn the path of a consumer and interact in real-time to help him optimize their financial decisions.

Today more than ever, consumers react to banks that respond to their needs and preferences. With big data and artificial intelligence, professionals of Digital Banking can use algorithms to transform data into valuable information to build the right products.

Banks, in general, need to invest in the right technologies, more than ever. With the appearance of new data flows, the focus is on the type of storage and the management agility. In this sense, cloud storage and parallel processing allow to leverage useful information in real-time throughout the entire organization, not only putting the information available among collaborators but also, improving the user experience of customers.

Finding and training new talents for Digital banking

The COVID-19 impact has forced financial institutions to connect with their customers through apps, online tools, and other unknown capabilities for many of their employees.

This has demanded the update of human resources in a context where all sectors are doing the same, that’s why smaller banks find it more difficult than bigger ones to deal with the competence gap. As the survey states about digital banking trends and priorities:

- Smaller banks have a bigger need of finding talents in digital banking, 24% as opposed to 12% for bigger banks.

According to Mauricio Claver-Carone, President of the Inter-American Development Bank (IDB), the lack of digital talent is a problem in Latin America and the Caribbean. Only in the developer segment, 1,000,000 people will be needed to cover needs in 2025.

The #Digitalbanking success requires more than technology and data analytics. As the book "The Technology Fallacy: How people are the real key to digital transformation" points out, the key for digital transformation has to do more with people than with technology. Leaders with basic skills are wanted, but with an agile mentality and the digital knowledge that will let them adapt to the environment whenever necessary.

The solutions for this shortage are outsourcing, developing plans to strengthen staff competencies, or onboarding technology vendors who will contribute with the right solutions to the needs of the moment.

Mobile banking: the future and present of Digital banking

Over 387.8 million people in Latin America and the Caribbean have turned their mobile phones into their personal offices. Thanks to the development of apps, they can now do a thousand tasks from the comfort of their homes. According to research by The Citi Mobile Banking, the use of mobile banking has rocketed:

- 31% of people use banking apps on their mobile phones.

- 81% of consumers use mobile banking nine days per month.

One of the reasons is that mobile apps give time back to users, these trends have only increased during the pandemic, and they are expected to continue growing. In fact, a survey by Mobiquity points out that 90% of the surveyed customers assert that they will keep using digital technology in the new normal.

It’s hard for any bank to improve all their #DigitalBanking components overnight, but the sudden digital revolution the pandemic faced us with has already started.

Would you be interested in learning more about our solutions, to develop your app as the main entrance to your bank?